Avalora Hotel Insights

Discover everything about Avalora Hotel, from exclusive offers to local attractions.

Withdraw Like a Wizard: Magical Methods to Minimize Fees

Unlock the secrets to fee-free withdrawals! Discover magical methods to keep more money in your pocket and boost your financial savvy.

Top 5 Secrets to Withdraw Money with Minimal Fees

When it comes to withdrawing money, minimizing fees can significantly impact your overall savings. Here are the top 5 secrets to achieve that goal:

- Use ATMs in Your Network: Always try to withdraw money from ATMs that belong to your bank's network. This can save you from incurring hefty withdrawal fees that are often charged when using third-party ATMs.

- Choose the Right Account: Consider opening an account with a bank that offers low or no withdrawal fees. Many online banks provide better terms due to lower operational costs.

- Plan Your Withdrawals: Instead of making frequent small withdrawals, plan to withdraw larger amounts less often. This reduces the number of transactions and can help avoid multiple fees.

- Utilize Cash-Back Options: At grocery stores and other retailers, opt for cash-back transactions when making purchases. This way, you can obtain cash without any ATM fees.

- Be Aware of International Fees: If traveling abroad, check if your bank waives foreign ATM fees. Some banks have partnerships that allow for fee-free withdrawals.

By implementing these top 5 secrets, you can efficiently manage your money without succumbing to unnecessary fees. Always stay informed about your bank's policies and consider switching accounts if your current one doesn’t meet your financial needs. By taking the time to research your options, you can enjoy a smoother and more cost-effective withdrawal experience.

To get the best deals, make sure to check out our latest duel promo code and unlock exclusive offers.

A Comprehensive Guide to Understanding Withdrawal Fees

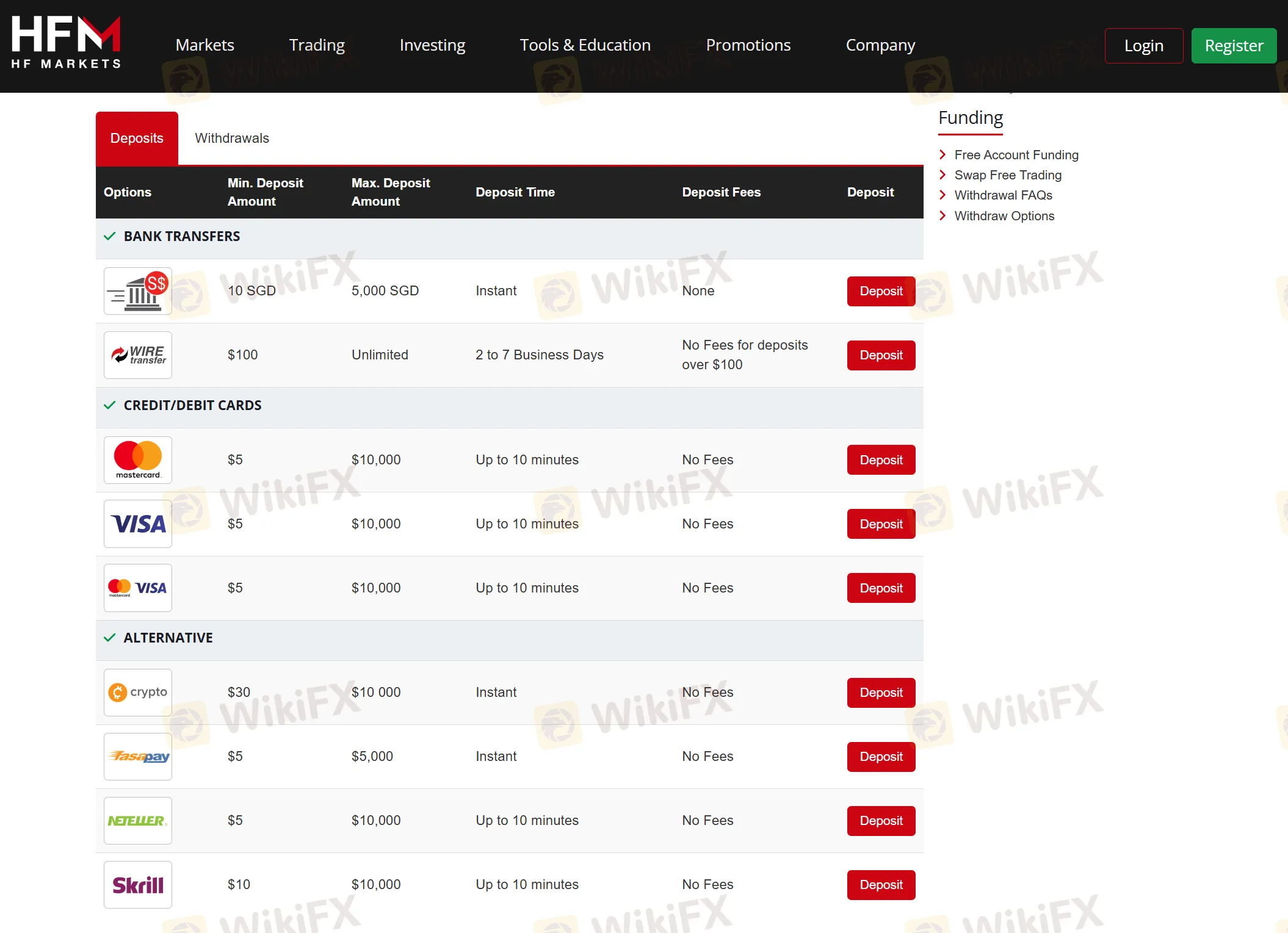

Understanding withdrawal fees is crucial for anyone engaging in financial transactions, whether it's through a bank, a trading platform, or any online service. These fees can vary significantly from one institution to another and can impact your overall returns or the cost of accessing your funds. When evaluating your options, consider factors such as the fee structure, minimum withdrawal limits, and any potential for hidden charges. Many services will disclose their withdrawal fees upfront, but it is essential to read the fine print, as some fees may not be immediately apparent until you initiate a transaction.

It is also important to note how withdrawal fees fit into the broader picture of your financial strategy. For instance, frequent transactions may result in compounded fees that significantly reduce your earnings over time. A good practice is to inquire about the fees associated with different withdrawal methods, as they can differ based on whether you're using bank transfers, e-wallets, or checks. By being proactive and doing your research, you can choose the most cost-effective way to manage your funds and minimize unnecessary expenses.

How to Choose the Best Withdrawal Methods for Your Budget

When it comes to managing your finances, choosing the best withdrawal methods for your budget is crucial. Start by assessing your financial goals and the frequency of your withdrawals. An effective method should not only accommodate your budget but also minimize fees. Common withdrawal options include bank transfers, e-wallets, and debit cards, each with its own advantages. For instance, e-wallets can offer quicker access to your funds, but they may come with withdrawal limits. Conversely, bank transfers often have lower fees but can take several business days for processing. Consider these factors when making your decision.

Next, evaluate the withdrawal methods based on convenience and accessibility. For example, if you need to access your funds urgently, prioritizing methods like instant e-wallet withdrawals can be beneficial. On the other hand, if you are more concerned about long-term savings, you might opt for a method that has lower transaction fees. Additionally, always keep security in mind; ensure that the withdrawal method you choose employs robust security measures to protect your financial information. By aligning your withdrawal strategy with your budget and needs, you can optimize your cash flow and achieve peace of mind.